Transferpricing 2020

Anual review.

Por (Autor) | Oct 14, 2020 |

While the introduction of the Organisation for Economic Co-operation and Development’s (OECD’s) base erosion and profit sharing (BEPS) action plan has remained the most important development in transfer pricing in recent years, 2020 has, of course, required companies and regulators to take pause. The catastrophic impact of the COVID-19 pandemic will be far reaching, with serious implications for the transfer pricing plans of many multinationals. the transfer pricing plans of many multinationals.

UNITED STATES

Clark Armitage

CAPLIN & DRYSDALE

“The most important US transfer pricing development this year is the effective non-participation of the US in the Organisation for Economic Co-operation and Development’s (OECD’s) Pillar 1 discussions on the taxation of the digital economy. A project that seemed to be on a fast track toward consensus, and would have proposed globally consistent rules allowing taxation in the absence of an in-country physical presence as a means of deterring heterogeneous unilateral measures primarily affecting US companies, was somewhat surprisingly thrown off track. For the present, the US seems to be disinclined to cooperate meaningfully on this issue.”

CANADA

Dale Hill

GOWLING WLG (CANADA) LLP

“The COVID-19 pandemic is the most important Canadian transfer pricing development of 2020. Taxpayers will need to explore whether their existing transfer pricing methodology is reflective of changing economic and company specific factors. The pandemic also has a significant impact on comparable data used to determine intercompany profits. The financial data reported by comparable companies is published subsequent to current year related-party transactions under review. We generally determine the reasonableness of profits for a given year by testing them against the margins reported by a set of comparables using data from prior years.”

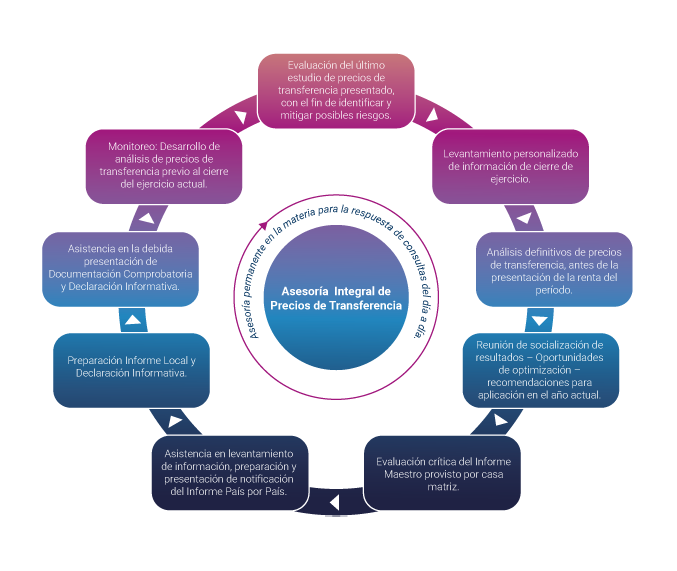

MEXICO

Mario Barrera

THOMPSON & KNIGHT

“Without question, the greatest development we have seen in the region has been the impact of the Organisation for Economic Co-operation and Development’s (OECD’s) base erosion and profit sharing (BEPS) action plan, which has led the Mexican government to adopt more reporting obligations, tougher rules and more stringent examinations. In terms of reporting, Mexico not only adopted the master file, the local file and the country-by-country report (CbCR), but also enacted this year provisions that require tax advisers and taxpayers to immediately report the development of certain transactions and structures that may result in a tax benefit.”

NETHERLANDS

Rezan Ökten

HOUTHOFF

“We consider the following two developments to be the most significant for the Netherlands. First, the introduction of the revised Dutch Tax Ruling Practice from 1 July 2019. Since the decree came into force, it has only been possible to have a prior consultation with the Dutch Tax Authorities (DTA) to obtain a Dutch international tax ruling if the taxpayer has sufficient economic nexus with the Netherlands, if saving Dutch or foreign taxes is not the sole or decisive motivation for engaging in legal acts or transactions, and the requested certainty does not relate to the tax consequences of direct transactions with entities established in low-tax countries and non-cooperative jurisdictions.”

LUXEMBOURG

Oliver R. Hoor

ATOZ TAX ADVISERS S.A.

“Luxembourg companies are often involved in financial transactions, such as debt funding, financing activities, guarantees, cash pooling and so on, therefore, the adoption of the new Organisation for Economic Co-operation and Development (OECD) guidance on transfer pricing aspects of financial transactions is of particular importance from a Luxembourg transfer pricing perspective. The economic turmoil resulting from the measures taken by governments around the globe to manage the COVID-19 pandemic may have a significant impact on the economic parameters that are relevant for the transfer pricing analysis. Thus, it should be verified whether existing transfer pricing studies need to be updated in order to reflect these changes.”

SPAIN

Eduardo Gracia

ASHURST LLP

“The main transfer pricing developments with an impact in Spain include the following. First, the Organisation for Economic Co-operation and Development (OECD) proposal for a ‘Unified Approach’ under Pillar One, which focuses on the allocation of taxing rights in a digitalised economy and seeks to undertake a coherent and concurrent review of the profit allocation and nexus rules but, at the same time, runs the risk of deviating from the arm’s length principle. Second, the launch of the OECD Transfer Pricing Guidance on Financial Transactions, although the Spanish Tax Administration had already been applying, to a large extent, the OECD criteria in this area.”

ITALY

Aldo Castoldi

STUDIO TRIBUTARIO E SOCIETARIO – DELOITTE

“The single event which is going to trigger the most significant transfer pricing developments has been the COVID-19 pandemic. Most sectors of all the major economies will likely be adversely affected by the crisis. The impact of the downturn on the global economy is growing. Forecasts of global growth assume a decrease of GDP growth in 2020. It is highly likely that the profitability of global supply chains will decrease as demand falls and manufacturing and logistic processes are interrupted. The impact of the downturn may vary across various industries, yet only a few appear to have not been hit by the recession and transfer pricing models will have to be adapted for the ‘new normal’.”

SINGAPORE

Sowmya Varadharajan

CROWE SINGAPORE

“There have been a number of key transfer pricing developments in Singapore of late. Given the importance of the commodity industry to Singapore, the Inland Revenue Authority of Singapore (IRAS) has built on guidance from the Organisation for Economic Co-operation and Development (OECD) and issued its own guidelines for commodity marketing and trading activities in May 2019. In line with recent developments globally and regionally, the IRAS has clarified that it requires all intercompany loans, either domestic or cross-border, to be compliant with the arm’s length principle. As foreign sourced interest income is only taxed in Singapore upon remittance, it is possible for Singapore taxpayers to offer interest-free loans.”

AUSTRALIA

Niv Tadmore

JONES DAY

“The underlying transfer pricing rules have remained stable over the last 12 months, other than a minor update to refer to the 2017 Organisation for Economic Co-operation and Development (OECD) Guidelines, and the updated guidance they contain following the OECD base erosion and profit shifting (BEPS) project, in the law. The most significant development has been the Federal Court’s decision in a transfer pricing dispute with Glencore. The decision, which is currently on appeal, substantially limits the Australian Taxation Office’s (ATO’s) powers to restructure transactions under the previous transfer pricing regimes in Australia.”

También te puede interesar